Economic linguistics

« previous post | next post »

According to Tim Arango, "I Got the News Instantaneously, Oh Boy", 9/14/2008, some so-far anonymous computational linguist caused United Airlines to lose more than a billion dollars of its market capitalization, over the course of about 12 minutes last Monday.

Here's Arango's reconstruction of the sequence of events:

At 1:36 a.m. E.D.T. last Sunday, Sept. 7, Google’s search “crawler” picked up a 2002 news article about United filing for bankruptcy from the Web site of The South Florida Sun-Sentinel; for some reason the outdated story had been listed on The Sun-Sentinel’s list of most popular business stories. (United emerged from bankruptcy protection in 2006.)

The next morning, an employee of the investment advisory firm Income Securities Advisors saw the story and posted it to the company’s own wire service, which is available over Bloomberg’s trading terminals. United’s stock plummeted soon after.

In a statement, the Tribune Company, which owns The Sun-Sentinel, said the bankruptcy story “contains information that would clearly lead a reader to the conclusion that it was related to events in 2002. … It appears that no one who passed this story along actually bothered to read the story itself.”

Mark Palmer, president of Streambase Systems, which designs software for automated trading, said: “What happens is the first crack in the ice is the news gets fed out to the algorithm, and that triggers it to sell. Someone puts in a big order and that gives the signal to other algorithms. Then another system picks up the sell order. That’s the whiplash. The problem is there’s a cascade effect.”

This timeline makes sense as written only if "1:36 a.m. E.D.T. last Sunday" actually means "1:36 a.m. E.D.T. last Monday", since there's no stock trading on Sunday.

Anyhow, the article suggests (without proof) that this was not some bleary-eyed trader reading the wire story without understanding it, but rather a consequence of the fact that

Wall Street’s computer scientists and linguists keep trying to find quicker ways to react to the news by creating ever-more complicated algorithms, the mathematical formulas that execute stock trades automatically based on such criteria as headlines and news stories.

Well, that and the fact that a six-year-old news story somehow found its way onto the Sun-Sentinel's web site — this is a rare enough event that apparently the newswire-scanning algorithms don't try to check for it. Or if they try, they didn't succeed in this case.

I reckon that a billion dollars is roughly equal to the past 50 years of investment in computational linguistics research — or about three days of the U.S. investment in the Iraq war. (Though I'll confess that I haven't done a time value of money correction, in either case…)

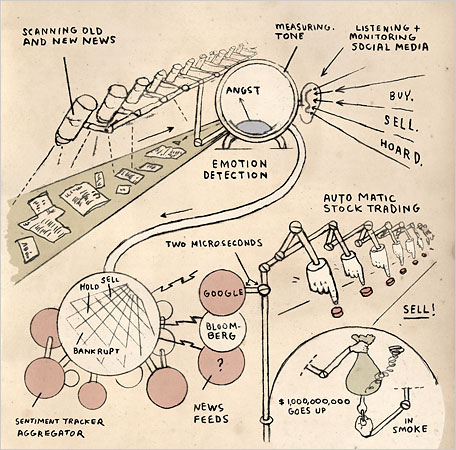

Arango's article comes with a nice illustration:

Tom Gilson said,

September 14, 2008 @ 12:45 pm

Starting at noon today EDT, just 18 minutes after this was posted, AMC aired War Games, about a computer's automatic response to an unexpected stimulus. Ironic.

Sili said,

September 14, 2008 @ 2:26 pm

Too late to make a mint now, I guess.

Unless some devious computational linguist already did that and is now gonna fund the next fifty years of research …

Nick Lamb said,

September 14, 2008 @ 4:14 pm

Speaking of "losing a billion dollars" of a capitalisation encourages the same error as saying "the average man" or "the average teenage girl" when speaking of a statistical result from some study done on twenty people.

The "billion dollars" of capitalisation doesn't exist as real money, any more than the "average man" is you or me, it's purely a way of understanding something else, and when it doesn't aid understanding, it's actively counter-productive.

Some short sellers made some money, some traders lost some money, some funds which owned those traders also lost some money. How much? Nobody will know exactly, maybe millions of dollars, maybe thousands of dollars, certainly not a billion, and whatever happened, none of it "went up in smoke" as illustrated.

Indeed that's why the SEC is investigating. They don't fear sentient computers trying to start a world war or an economic collapse, but instead master manipulators finding a way to force a named stock to rise (or in this case, fall) on their command, siphoning money away from legitimate investors. For the SEC this is the same as finding a copy of tomorrow's WSJ with a headline about Steve Jobs leaving Apple. Merely a bizarre mistake? Prank gone wrong? Or scam? They need to find out to restore confidence.

rootlesscosmo said,

September 14, 2008 @ 5:47 pm

I think this

“What happens is the first crack in the ice is the news gets fed out to the algorithm, and that triggers it to sell. Someone puts in a big order and that gives the signal to other algorithms. Then another system picks up the sell order. That’s the whiplash. The problem is there’s a cascade effect.”

deserves to be entered in the Metaphor Density Sweepstakes. An act of feeding causes a crack in the ice which causes someone to send a signal that gets picked up; this is a whiplash, which has the effect of a cascade.

Looks like a smoking gun to me.

Neal Zupancic said,

September 14, 2008 @ 8:29 pm

"This timeline makes sense as written only if "1:36 a.m. E.D.T. last Sunday" actually means "1:36 a.m. E.D.T. last Monday", since there's no stock trading on Sunday."

It says the stock plummeted soon after the ISA employee caught the story the morning after ("The next morning,") Google's crawler picked it up. Technically if the crawler got the story at 1:36 am Sunday, the crawler got the story on Sunday morning, thus the next morning would refer to Monday.

Garrett Wollman said,

September 14, 2008 @ 9:43 pm

In the broadcast media and probably many other businesses as well, the day begins at a more convenient time than midnight — often 5:00 AM (or 5:00 a.m. if you're writing for the Times). I suppose in the traditional print media it would make sense to begin the day early rather than late.

John Baker said,

September 14, 2008 @ 11:15 pm

The supposed loss of a billion dollars is a bit misleading. UAL Corporation (the parent of United Air Lines, Inc.) has 126,593,928 shares of common stock outstanding. Prior to the dissemination of the false information, its stock was trading at about $12 per share, so its market capitalization was about $1.52 billion. In the wake of the market's reaction to the story, the price reached a low of $3.00 per share. When the price was at that level, UAUA (its stock ticker symbol) had, temporarily, a market capitalization of about $380 million, or about $1.14 billion less than its level a few minutes earlier. When correct information was in the marketplace, UAUA's stock rebounded, closing at $10.92 per share. The only actual losses, therefore, were from the trades made during the few minutes when the price was depressed.

James Wimberley said,

September 15, 2008 @ 7:26 am

Arango: "…Google’s search “crawler” picked up a 2002 news article …"

Why does Arango think crawler needs the quotation marks required for unfamiliar jargon? In an article for general readership, I'd put say spambot in quotes, but not crawler, especially as it's modified by the explanatory Google search. In fact, if you can use a word or phrase without explanation, why use quotes except for attribution?

Aaron Davies said,

September 15, 2008 @ 10:36 am

@James Wimberley, I'm reminded of my amusement at the MSM's continued slavish obedience to the "expand all acronyms once" rule, even when the expansion is more confusing (and much less common) than the acronym. Does it really do the general public any good to read about the "newly revised request for comments (RFC) regarding hypertext transfer protocol (HTTP) over transmission control protocol/internet protocol (TCP/IP)"?

@Garrett, I'm reminded of the odd phenomenon of reading news articles on the web, referring to events of the past hour, which are clearly written in a form of the past tense that's meant to hold up when they go to the archives. E.g. "The incident occurred at 4:30 pm, June 23rd" when it's currently 5:15 of the same day.

Forrest said,

September 16, 2008 @ 3:37 pm

It's pretty interesting that they chose to stylize the illustration to look like it came from a bygone age.

It's also interesting ( but hardly linguistic ) that

describes a positive feedback loop. Positive is a technical term, and maybe a little misleading; a better description of what's going on would be a death-spiral of gloom, that happens like dominoes. Seems like the opposite of what anyone interested in maintaining the system and faith in the system would actually want.

( On the other hand, a negative feedback loop negates changes to the system, instead of amplifying them, as we've just seen happen. )

Irene Fricker said,

September 17, 2008 @ 5:38 pm

No comments on the allusion to Lennon & McCartney's "A Day in the Life" in the title of Tim Arango's article? Rather forced, but clever enough.