We play Haydn until the sun comes up

« previous post | next post »

Kevin Knight wrote that "our approach to syntax in machine translation is best described in D. Barthelme's short story 'They called for more structure'", and a few days ago, Jason Eisner described what Kevin meant. So in the same spirit, here's Donald Barthelme on the past future of journalism, originally published under the title "Pepperoni" in the New Yorker, in the 12/1/1980 issue, and reprinted in Overnight to Many Distant Cities, 1983, under the title "Financially, the paper. . ."

Financially, the paper is quite healthy. The paper's timberlands, mining interests, pulp and paper operations, book, magazine, corrugated-box, and greeting-card divisions, film, radio, television, and cable companies, and data-processing and satellite-communications groups are all flourishing, with over-all return on invested capital increasing at about eleven per cent a year. Compensation of the three highest-paid officers and directors last year was $399,500, $362,700, and $335,400 respectively, exclusive of profit-sharing and pension-plan accruals.

But top management is discouraged and saddened, and middle management is drinking too much. Morale in the newsroom is fair, because of the recent raises, but the shining brows of the copy boys, traditional emblems of energy and hope, have begun to display odd, unattractive lines. At every level, even down into the depths of the pressroom, where the pressmen defiantly wear their square dirty folded-paper caps, people want management to stop what it is doing before it is too late.

The new VDT machines have hurt the paper, no doubt about it. The people in the newsroom don't like the machines. (A few say they like the machines but these are the same people who like the washrooms.) When the machines go down, as they do, no infrequently, the people in the newsroom laugh and cheer. The executive editor has installed one-way glass in his office door, and stands behind it looking out over the newsroom, fretting and groaning. Recently the paper ran the same stock tables every day for a week. No one noticed, no one complained.

Middle management has implored top management to alter its course. Top management has responded with postdated guarantees, on a sliding scale. The Guild is off in a corner, whispering. The pressmen are holding an unending series of birthday parties commemorating heroes of labor. Reporters file their stories as usual, but if they are certain kinds of stories they do not run. A small example: the paper id not run a Holiday Weekend Death Toll story after Labor Day this year, the first time since 1926 no Holiday Weekend Death Toll story appeared in the paper after Labor Day (and total was, although not a record, a substantial one).

Some elements of the staff are not depressed. The paper's very creative real-estate editor has been a fountain of ideas, and his sections full of color pictures of desirable living arrangements, are choked with advertising and make the SUnday paper fat, fat, fat, fat. More food writers have been hired, and more clothes writers, and more furniture writers, and more plant writers. The bridge, whist, skat, cribbage, domino, and vingt-et-un columnists are very popular.

The Editors' Caucus has once again applied to middle management for relief, and has once again been promised it (but middle management has Glenfiddich on its breath, even at breakfast). Top management's polls say that sixty-five percent of the readers "want movies," and feasibility studies are being conducted. Top management acknowledges, over long lunches at good restaurants, that readers are wrong to "want movies" but insists that morality cannot be legislated. The newsroom has been insulated (with products from the company's Echotex division) so that the epople in the newsroom can no longer hear the sounds in the streets.

The paper's editorials have been subcontracted to Texas Instruments, and the obituaries to Nabisco, so that the staff will have "more time to think." The foreign desk is turning out language lessons ("Yo temo que Isabel no venga," "I am afraid that Isabel will not come"). There was an especially lively front page on Tuesday. The No. 1 story was pepperoni — a useful and exhaustive guide. It ran right next to the slimming-your-troublesome-thighs story, with pictures.

Top management has vowed to stop what it is doing, not now but soon, soon. A chamber orchestra has been formed among the people in the newsroom, and we play Haydn until the sun comes up.

Searching for this on the web, I found that John Holbo quoted from it on Crooked Timber, 12/4/2013, under the title "Not now, but soon, soon", as a comment on Farhad Manjoo's profile of Neetzan Zimmerman, "the Gawker writer who picks the linkbait stories like no one else, apparently", suggesting that Barthelme "envisons a kind of Gawkerization of media".

D.O. said,

February 28, 2015 @ 8:17 pm

"…with over-all return on invested capital increasing at about eleven per cent a year. "

Technically, that means that if the "paper" makes, say, 20% return on investment in one year, the next year it is about 22.2%. I suspect though that what is really meant is that the return on investment is 11%, not it's increase. If this hypothesis is correct, then either Mr. Barthelme made a mistake or he parodies some rhetorical figures of financial reporting.

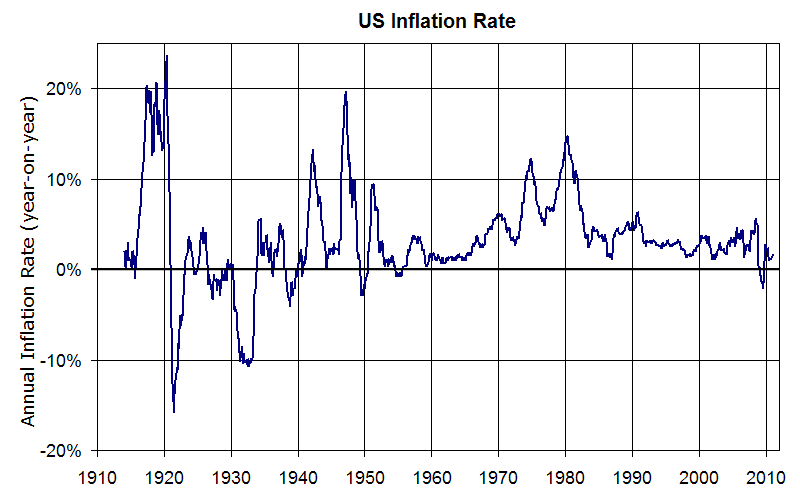

[(myl) Remember that the U.S. inflation rate in 1980 was 14% or so:

]

Dan Lufkin said,

February 28, 2015 @ 10:26 pm

Isn't that just Poe's law at work on a broader palette?

D.O. said,

February 28, 2015 @ 11:53 pm

Maybe. Of course, the whole text is ironic and Mr. Barthelme couldn't care less about returns on investment and such. It means that I mischaracterized the dichotomy. It's either the author has inserted this mistake by design or simply included typical verbiage without thinking what it means. Contrary to the Poe's law, it doesn't matter either way.

D.O. said,

March 3, 2015 @ 12:21 am

I am not economist and may be very wrong, but during inflation both numerator and denominator of return-on-investment are being inflated.

[(myl) I don't think so — Investopedia gives a separate definition for "inflation-adjusted return", which incorporates the unadjusted ROI as a component.

So in a period of rising inflation — e.g from 1977 to 1980, when U.S. inflation rose from about 5% to about 15% — the unadjusted ROI might be expected to increase equally sharply in relative terms.

Not that Barthelme gives any indication over ever having had a quantitative thought. No doubt this is just some reverberations of WSJ-speak.]